Borang EA / EA Form

What is Borang EA/EA Form?

LHDN defined EA Form as an Annual Remuneration Statement for private employees, which includes their salaries for the past year. EA Form ensures that you declare the right amount of earnings and exemptions and certify whether you are above the pay grade that requires you to pay taxes.

According to Section 83(1A) Income Tax Act 1967, employers must provide and distribute the EA Form before 1st March every year. Failure to do so may result in a fine of RM200 to RM20,000 or imprisonment for a term not exceeding 6 months, or both.

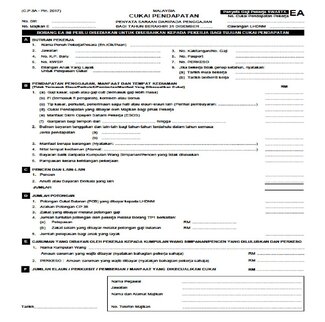

Understanding Borang EA/EA Form

- B1 (a)-(f): Remuneration, Wages, Leave Pay, Fee, Commission, Bonus, Perquisites, Allowance, Income Tax, Gratuity

- B2: Type of income

- B3: Benefits in kind (BIK) – non-cash benefits such as the provision of accommodation, company car, driver, leave passage, and more.

- B4: Value of living accommodation (VOLA)

- B5: Refund from unapproved Pension/Provident Fund

- B6: Compensation for loss of employment

- Note: To help taxpayers who have lost their jobs due to the unprecedented pandemic, the income tax exemption limit for compensation for loss of work is enhanced to RM20,000 instead of RM10,000 for a single year of service for YA (year of assessment) in 2020 and 2021.

Generate EA Forms with Kakitangan.com

Kakitangan.com helps you to generate and distribute accurate payslips and EA Forms seamlessly.

Run your payroll with us and let us do the work.

Learn more

Frequently Asked Questions (FAQ)